If you established a Revocable Living Trust in the recent past or anytime in the past, remember that after establishing your Trust, you must also “fund” the Trust. Funding it means to place things into the Trust so that it can be administered and carried out the way it is intended.

If you haven’t funded your real property into your Revocable Living Trust, you can do so by signing (before a notary public) a Quitclaim Deed and subsequently recording it locally with the San Diego Recorder’s Office. Only real property physically located here in the county can be controlled by the San Diego County Recorder’s Office. If you live in San Diego, but have real property physically located outside of this county, you will have to seek assistance that that county’s Recorder’s Office for assistance in funding your Trust or other real property matters.

The following is more information published from the San Diego County Recorder’s Office as of July 6, 2015. You are encouraged to review their official website for current information.

The County Recorder, upon payment of proper fees and taxes, will accept any document which is authorized or required by California law to be recorded, if the document contains required information and if it is photographically reproducible.

For your convenience, documents may be presented for recording in the Assessor/Recorder/County Clerk offices at the addresses listed below.

|

County Administration Center

1600 Pacific Highway, Suite 260

San Diego, CA 92101

|

El Cajon Branch

200 S. Magnolia Ave

El Cajon, CA 92020 |

San Marcos Branch

141 East Carmel St.

San Marcos, CA 92078 |

All applicable fees must be paid at the time of recording, click RECORDING FEES.

For information on hours of business and directions to the office locations, quit this option and

click PHONE #’S/LOCATIONS.

Each document presented for recording MUST include or comply with the following general requirements.

If any portion of your recordable document is in a foreign language*, it must be translated into English. The translator will need to complete a Declaration and Verification of Interpretation form for submission to the County Clerk. The County Clerk will then complete a Translation Certificate for a fee of $10.00. Both the Declaration of Interpretation and the Translation Certificate forms must be completed and attached to the document prior to recording.

The document should not contain more than the last four digits of the Social Security number, pursuant to Civil Code 1798.89. This does not apply to documents executed prior to January 1, 2010 or certified copies of the death certificate attached to the documents.

- The property must be located in San Diego County.(CC1169)

- The document must be authorized or required by law to be recorded. (GC 27201)

- The document must be submitted with the proper fees and taxes. (GC 6301, 27201, 27261)

- The document must be in compliance with state and local laws.

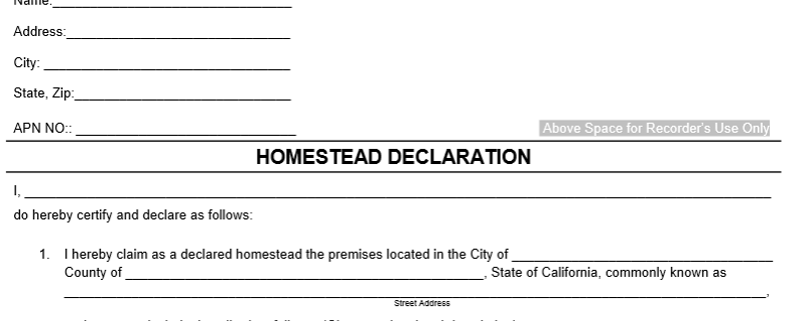

- The document should Name the person requesting recording. (GC 27361.6)

- The document should state the Name and address to whom the document should be returned, fill in “Recording Requested By and Mail To”. (GC 27361.6)

- The document must be legible enough to produce a readable photographic record.(GC 27201, 27361.6, 27361.7)

- Signatures must be original unless the document is a certified copy issued by the appropriate custodian of the public record. (GC 27201b, GC 28288, Evid Code 1530)

- The document must be properly acknowledged, unless exempt. All purpose acknowledgments taken in California must be completed as prescribed by law. Any certificate of acknowledgment taken in another place shall be sufficient in this state if it is taken in accordance with the laws of the place where the acknowledgment is made. (GOV 27201, 27285, 27287, 27288, 27289, CIV 1189)

- The Assessor’s Parcel Number is required on deeds by local Ordinance. (R&T 11911.1)

- The notary seal must be legible for a microfilm reproduction .(GC 8207)

Documentary Transfer Tax is due on all taxable conveyances in excess of $100 at a rate of $.55 per $500 or fractional portion of real property value; excluding any liens or encumbrances already of record as required, per Revenue and Taxation Code 11911. It is collected at the time of recording on each deed, or instrument. A Documentary Transfer Tax Declaration must be completed and signed for all deeds. If no Documentary Transfer Tax is due, so indicate by entering “0” on the tax line and sign the declaration. Please explain the reason why no tax is due on the document or on a separate signed statement.(R&T 11932)

When transferring property to ANYONE a “Preliminary Change of Ownership Report” IS REQUIRED per the Revenue and Taxation Code 480.2, click PRELIMINARY CHANGE OF OWNERSHIP REPORT. This document is in Acrobat PDF format.

If a “Preliminary Change of Ownership Report” is required, but not submitted at the time of recording, please include an additional $20.00 for the Ownership Change fee. Preliminary Change of Ownership Forms are available at the customer counter or it can be mailed to you upon request by calling (619) 238-8158.

You may also mail in your documents for recording with a check,cashiers check or money order made payable to:

The San Diego County Assessor/Recorder/Clerk

P.O. Box 121750

San Diego, California 92112-1750

Your request is processed upon receipt. Please allow 2-4 weeks to receive your original recorded document back in the mail.

The office of the Recorder/County Clerk is PROHIBITED from giving ANY legal advice or to assist in document preparation. We DO NOT provide any notarial services. Various types of forms may be purchased at office supply or stationary stores.

Once you have the appropriate form, you may prepare it yourself, consult legal counsel or contact a local title company or escrow company.

Photo Credit: San Diego County.gov